We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Renters insurance can be a valuable asset for tenants who want to protect their belongings in a worst-case scenario such as a burglary. This type of insurance can help renters cover the cost to purchase replacement items if their possessions are stolen or damaged by a covered event. Since landlords are not responsible for tenants’ belongings, renters without sufficient coverage may be left to pay to replace their possessions entirely out of pocket. As such, purchasing renters insurance may be worth it for tenants because this type of policy can help protect their belongings and recoup any losses after a covered event.

As a nationwide insurance company, State Farm may appear to be a safe choice for tenants looking to buy renters insurance. The company claims to provide affordable coverage to policyholders all across the country, but can it deliver on this promise? Our State Farm renters insurance review weighs the provider’s benefits and drawbacks so tenants can make a more informed decision when comparing their renters insurance options and purchasing coverage.

See more of the best renters insurance companies.

At a Glance

State Farm Renters Insurance

See ItOur Verdict: State Farm offers solid renters insurance policies at relatively reasonable rates. The company’s nationwide footprint means that tenants across the country can apply for a policy, and the variety of support options—including mobile and online tools—can make getting a quote or filing a claim easy to accomplish under many circumstances.

SPECS

- Coverage area: 50 states and Washington, D.C.

- Additional policies: Vehicle, life, health, small business, pet, umbrella

- Quote process: Online, phone, agent

- Claims process: Online, phone, agent, app

- AM Best rating: A++

- Sample monthly cost: $11.08

PROS

- Monthly costs are typically lower than those of competitors and the national average

- Excellent customer satisfaction according to the National Association of Insurance Commissioners

- User-friendly policy and claims management via award-winning mobile app

- A++ AM Best rating

- User-friendly website

CONS

- Discounts vary by state and will not be available to every renter

State Farm Renters Insurance Review: Claims

State Farm presents itself as an insurance company that’s capable of providing personalized support at an affordable rate. The company’s website focuses on options for policyholders to lower their insurance rates, such as by bundling auto and home or renters policies. Potential customers are also urged to contact a representative to receive a personalized policy that is tailored to their needs and specifications.

The company also bills itself as a technologically sophisticated insurance provider with the resources to provide a more satisfying customer experience. For instance, State Farm heavily promotes its mobile app, which features advanced capabilities such as biometric login credentials and smart-watch compatibility. This combination of major carrier resources and a personalized touch can certainly be appealing, but does State Farm’s renters insurance hit the mark?

About State Farm Renters Insurance

Based out of Bloomington, Illinois, State Farm offers insurance products—including renters insurance—in all 50 states as well as Washington, D.C. According to the company’s website, State Farm has more than 19,000 agents located across the country to help customers with their insurance needs. With a century of experience under its belt—the company was founded in 1922—State Farm brings significant expertise to the insurance market, which may appeal to renters who would prefer to work with an established company over newer organizations.

State Farm’s finances are also strong, with the company holding an A++ rating from AM Best. This is the highest rating bestowed by the independent credit rating agency—a distinction restricted to only a few insurance companies that can demonstrate a superior ability to meet their obligations to customers. Such a high rating indicates that State Farm has an excellent credit rating, along with a healthy financial situation. The benefits of this high rating for customers are twofold: They can feel confident that State Farm will continue to provide coverage for the foreseeable future and that the company will have sufficient funds on hand to pay out insurance claims.

State Farm’s slogan, “Like a good neighbor, State Farm is there,” reflects its stated commitment to its customers and their communities. The company is involved in a number of community grants, sponsorships, and partnerships to promote environmental and social awareness. This community involvement may appeal to renters who want to work with an insurance company that supports the same ideals they care about most.

Customers’ Online Experience

State Farm provides a fairly strong online experience for customers looking to purchase renters insurance. The online quote tool is transparent and easy to use, allowing renters to see their estimated insurance rate in short order. After customers provide their address, the tool will show them the average price of renters insurance paid by other tenants in their ZIP code. However, in some cases, the quote tool can time out fairly quickly and without notice, forcing users to re-enter their information to get back to their quote.

Once they have their quote in hand, customers can choose to finalize their purchase and enroll in a policy through the State Farm website. It’s worth noting that coverage is subject to application approval, which is not guaranteed even after a customer makes an initial insurance premium payment. This all-digital customer journey may appeal to renters who would prefer to avoid contacting an insurance agent when signing up for coverage. Renters may also find this online process helpful because State Farm will send proof of coverage right away in case their landlord requires renters insurance.

Other online resources can be somewhat limiting for site visitors who are interested in renters insurance. Although State Farm has several FAQ pages covering insurance questions, for instance, none of them address renters insurance specifically. Another drawback is that State Farm does not allow policyholders to cancel their insurance policies online; instead, customers will need to either speak to an agent over the phone or in person to cancel their coverage.

What’s Included?

What does State Farm renters insurance cover for tenants? A standard renters insurance policy from State Farm will provide personal property coverage up to $20,000. This coverage protects tenants’ belongings such as furniture, clothing, and electronics in case they are stolen, vandalized, or damaged by fire or storms. Renters can choose to increase this limit if they want, with coverage amounts capped at $110,000. Policyholders will also receive personal liability protection with a coverage limit of $100,000, which provides coverage in the event that they cause property damage themselves or are liable for another person’s injury. They can choose a higher coverage amount up to $1 million, but doing so will raise their monthly premium. State Farm also provides $1,000 of coverage to pay for medical expenses if a visitor is injured on the renter’s property due to no fault of the renter. Policyholders can also increase their coverage amount for medical payments to others up to $10,000, which will lead to a higher premium.

State Farm renters insurance coverage may have some limitations on certain types of possesions. For instance, each policy includes $1,000 coverage for jewelry and furs, with the option to raise policy limits up to $5,000. Silverware and goldware are also covered with a separate limit—$2,500 is included, but renters can raise that to $10,000 if they need more protection. A notable inclusion that may not be available with other renters insurance policies is standard $2,500 coverage for firearms. Renters also receive $1,500 in business property protection, which can help pay to replace any possessions in the rental unit that are used to run a business (except for computers and laptops).

What’s Not Included?

Renters insurance does not cover property damage to the building itself, including the roof or siding, as this type of damage should be covered by the landlord’s insurance. State Farm policies also do not include coverage for water damage caused by flooding or underground water. The caveat to this exclusion is that renters can choose to purchase an endorsement for sewer and drain backups, which may cover incidents involving overflowing water. In a similar vein, although renters policies do not include earthquake coverage by default, policyholders can buy add-on endorsements that help pay to replace personal property damaged during seismic activity.

Prospective customers may want to be aware that renters insurance only provides coverage to the policyholder, even if a rental property has multiple tenants living in the same space. This means that a State Farm apartment insurance policy will not protect possessions owned by the policyholder’s roommates. Also, as noted, State Farm’s business property protection excludes computers and laptops from its coverage, so renters who run their own business out of their home may need to purchase additional coverage elsewhere. In addition, it’s a good idea to take note of the different coverage amounts for certain types of belongings. State Farm policies set separate coverage limits for jewelry, fur coats, and other high-value items, and those coverage caps are often significantly lower than what it might cost to replace those items.

Extra Coverage Options

State Farm offers a number of extra coverage options for policyholders to either add to their renters insurance or purchase as a separate policy. Add-on coverage includes drain or sewer backup to pay to replace rental unit contents that are damaged or destroyed by ground water or sewage overflows. This policy option only pays a certain percentage of the damaged property’s value—either 15 percent or 30 percent—rather than cover replacement costs up to the policy limit. Renters who live in areas prone to seismic activity may be interested in State Farm’s earthquake endorsement, which covers personal property damaged during an earthquake. Deductible options range from 5 percent to 20 percent of the personal property coverage limit. State Farm also offers cyber event, identity restoration, and fraud loss protection as an extra endorsement. This coverage option will help pay to remediate instances of identity theft and fraud stemming from a cyberattack or data breach, and it will cover the costs to restore the policyholder’s identity and mitigate the effects of any compromised personal data.

Renters have a variety of other specialized coverage options they can choose from, including policies to insure at-home day care businesses, off-premises structures owned by the policyholder, and waterbeds. These additional policies may only appeal to a small portion of renters, but they can provide added value in the right circumstances.

Cost and Discounts

State Farm renters insurance premiums tend to be in line with or possibly even lower than industry averages. That being said, renters insurance costs will vary from state to state, and some renters may pay higher rates depending on the location of their rental unit or rental home. Insurance rates are also impacted by the amount of coverage selected for personal property, personal liability, and medical payments to others coverage. Adjusting the deductible will also either raise or lower a policyholder’s premium. Renters who decide to add extra endorsements, such as earthquake or water backup coverage, will pay higher premiums in return for this expanded coverage. Policyholders can choose to make payments on their insurance premiums on a monthly, quarterly, semiannual, or annual basis.

Although discount opportunities can be somewhat limited, there are a few ways that State Farm enables renters to lower the cost of their insurance. State Farm will automatically apply a discount to insure properties that do not have a record of claims being filed in the past. Policyholders can also save money on their State Farm rental insurance if they bundle it with an auto insurance policy. Renters will need to speak directly to a State Farm agent if they want to add other policies to their coverage and take advantage of bundle discounts. Tenants may also qualify for a discount if their rental unit has safety features such as smart monitoring systems and burglar alarms. In some cases, the company claims policyholders could save up to 17 percent on their plan by taking advantage of available discounts.

Getting a Quote

Renters often have the option to get a quote from State Farm either online, over the phone, or with a local agent. It’s worth noting, however, that online quotes may not be available in all circumstances. Depending on the ZIP code provided, renters may be required to speak to an agent to receive a quote on renters insurance. Getting a quote online is fairly easy to accomplish, though, and State Farm’s quote tool allows customers to adjust different coverage terms to get a more accurate estimate on their renters insurance. For instance, while standard renters policies include $20,000 of personal property coverage, customers can enter whatever amount they like up to $110,000.

Other types of coverage, such as personal liability and medical payments to others, give renters the ability to customize their coverage limits as well. Renters can also select from three deductible options: $500, $1,000, or $2,000, which are all pretty standard for a renters insurance policy. With each selection a customer makes, the online quote tool will recalculate to update the estimated monthly rate. If, at any point during the process, customers wish to speak to an agent, State Farm presents several local agents to contact for additional assistance. When a customer is ready to move forward with their renters insurance policy, then can apply online and submit their first payment right away. However, that application will still need to be reviewed by underwriters before coverage can begin, and it’s unclear how long that process could take.

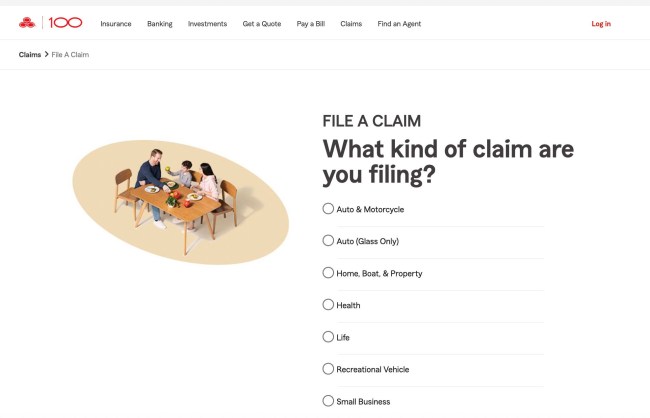

Filing a Claim

State Farm offers a few different ways for policyholders to submit a claim on their renters insurance. Renters can file a claim on damaged or stolen property through the online portal, but first they will need to sign into their State Farm account. Although filing a claim online can be expedient, policyholders may want to contact their State Farm agent regardless to receive more hands-on support. Renters can reach out to an agent over the phone or through a local branch office to start the claims process.

Policyholders can also choose to submit their State Farm renters insurance claim through the company’s dedicated mobile app, which may be an easy way to upload photos and documents related to the claim. This mobile app has been recognized for its usability and performance on multiple occasions, including winning three Webby Awards in 2020.

For claims regarding stolen property, State Farm urges policyholders to file a police report before submitting a claim so the incident can be documented. In addition, the company recommends that policyholders maintain a home inventory checklist with receipts and photos for all covered belongings. Having this documentation on hand can help renters show proof of value and ownership when filing a claim.

After submitting a claim, policyholders can check its status through any of the supported channels: online, over the phone, through the mobile app, or by speaking to a local agent. It’s not clear exactly how long the claims process will take before a policyholder receives a payout, but with State Farm’s A++ AM Best rating, policyholders probably don’t need to worry about State Farm not paying claims.

Additional State Farm Policies

As a nationwide insurance carrier with ample resources, State Farm can provide various types of insurance coverage for renters to consider. For instance, the company’s Trupanion offering provides pet insurance for dogs or cats owned by tenants. State Farm’s pet insurance does not extend coverage to other animals, such as turtles, lizards, ferrets, or guinea pigs, so it may not be the right policy for renters who have more exotic pets.

As noted, State Farm also offers auto insurance, which can be bundled with renters insurance at a lower premium. Renters who own motorcycles, boats, or off-road vehicles such as ATVs can purchase separate policies to cover these vehicles as well. Bundle discounts may not be available for those plans, though. State Farm policyholders can also buy life insurance, including term life, whole life, and universal life insurance plans. Renters who want more expansive liability coverage may want to look into the company’s personal liability umbrella options, which offer coverage amounts starting at $1 million. When renters are ready to buy a home of their own, they can get either a homeowners or condo insurance policy through State Farm to protect both their possessions and their property.

Customer Service Experience

Because State Farm offers so many ways to manage policies—online, via the mobile app, over the phone, or through a local branch office—policyholders should be able to receive the level of support and customer service they need in many circumstances. For instance, online and mobile platforms allow customers to manage their policies and file claims whenever they like. That being said, State Farm’s customer support line is not open 24 hours a day, so policyholders may need to call during regular business hours in order to receive assistance from a live agent.

State Farm maintains separate phone numbers for filing claims, making insurance payments, and receiving more general customer service, which can be a bit of a double-edged sword. On the one hand, dedicated contact numbers can result in quicker response times and faster resolutions since policyholders can be connected with the right representatives as soon as possible. However, this setup may also be confusing for customers who are unsure of which number they should call if they have a general question—how does State Farm renters insurance work, for instance.

Policyholders can also find answers to common questions regarding their account—how to retrieve their user ID and password or change coverage options online, for example—on State Farm’s website. The scope of questions answered online is extensive, and may help customers avoid spending a lot of time on the phone waiting to speak to a representative.

State Farm Renters Insurance Reviews by Customers

When deciding on an insurance provider, it can be helpful to look at reviews from former and current customers. How is State Farm insurance rated by its customers? State Farm has received generally favorable reviews regarding its renters insurance from customer review sites. The company holds a high average satisfaction rating from Consumer Affairs, with customer reviewers calling out the extent of coverage available, along with the low insurance rates and responsive customer service. Several customers noted how easy they found the company’s representatives to work with when they needed to change coverage or switch policy terms. SuperMoney customer reviews mostly recommended State Farm for renters insurance coverage as well. Positive reviews mentioned the affordability of State Farm policies, as well as the hands-on support provided by customer service teams. Other customers enjoyed the option to file claims through the company’s mobile app and save money on their insurance by bundling their auto and renters policies.

Reviewers on WalletHub were a bit more restrained in their praise for the company and its renters insurance offering, although feedback was fairly positive overall. In some instances, customers complained about lengthy claim processing times and denied claims on water damage. However, it’s worth noting that renters insurance often excludes certain types of water damage. In addition, many negative reviews focused on State Farm’s auto insurance, rather than its renters insurance offering, which may have impacted WalletHub’s overall satisfaction rating.

How State Farm Renters Insurance Stacks Up to the Competition

State Farm stands out among renters insurance providers in several ways, starting with its coverage area. The company has a nationwide footprint, offering renters insurance to residents in all 50 states as well as Washington, D.C. Such an extensive service area is not always a given with renters insurance. American Family Insurance, for instance, only provides this coverage in 19 states, while Lemonade offers renters insurance in 29 states. State Farm also holds an A++ rating from AM Best, which is the best ranking possible, reflecting its strong credit and healthy finances.

Another feature that distinguishes State Farm is its dedicated mobile app, which policyholders can use to manage their insurance policy and file a claim. As noted, this app has garnered a lot of praise over the years for its usability and functionality, winning multiple awards. Other large carriers, such as Nationwide, may not offer a mobile option to submit and track renters insurance claims.

State Farm may come up a bit short when it comes to discount opportunities, though. There are only a few discounts available for policyholders to take advantage of to lower their insurance rates. That may not be too large a concern for some renters, thanks to State Farm’s relatively low premiums on standard renters insurance policies. Compared with industry averages on renters insurance, State Farm cost estimates may be very affordable.

Should You Get State Farm Renters Insurance?

State Farm may be a good option for many renters looking to insure their personal property against theft or damage. Thanks to State Farm’s nationwide footprint, renters can receive coverage from any location in the country. In addition, the company’s standard rates for renters insurance tend to be on the low end—although premiums will increase for policyholders who want to expand their coverage with higher limits or additional endorsements. State Farm also provides customers with different ways to check on their policy and file insurance claims. In particular, the option to manage claims online or through the company’s mobile app can be very convenient for renters who are more comfortable with digital platforms.

The coverage provided by a State Farm renters insurance policy is pretty standard; there are no glaring exclusions, but policyholders won’t receive any noteworthy or exceptional coverage terms as part of a basic policy either. Customers do have the option to expand their coverage with add-ons, however, and being able to purchase endorsements for sewer backup or earthquake damage could be very appealing under certain circumstances. When searching for the best renters insurance companies, tenants may want to get a quote from State Farm and see what coverage options and rates are available to them.

We independently reviewed this service by weighing the company’s claims against first-hand experience with its professionals. However, due to factors such as franchising, human error, and more, please note that individual experiences with this company may vary.