We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Owning a house or condo can be expensive, and that’s before taking into account the cost to maintain appliances and home systems. When HVAC systems, refrigerators, or water heaters break down, the cost for repair or replacement could be significant. A home warranty can reduce the out-of-pocket costs of such repair work by helping to pay qualified technicians to fix malfunctioning equipment or even footing the bill to replace appliances that are no longer working and cannot be repaired.

American Home Shield offers a few different home warranty policies to cover the cost to fix or replace various appliances and home systems. The company promises to help save homeowners money when systems and appliances around the house inevitably break down as a result of wear and tear. American Home Shield strives to inspire confidence, noting the large number of appliances and systems that can be covered with its policies, including items that break down due to age, poor maintenance, or pre-existing conditions.

But is American Home Shield worth it? With our American Home Shield review, we set out to inspect the company’s claims, benefits, and potential issues to see how it compares to other home warranty options.

See more of the best home warranty companies, best home warranties for condos, best home warranties for rental properties, and the best home services.

At a Glance

American Home Shield

Pros

- Extensive coverage options

- Relatively high coverage caps

- Guest-unit coverage available

- Coverage for unknown pre-existing conditions

- Coverage for improper installations and repairs

- Free or discounted HVAC tune-ups

- Generous appliance discount program

- 24/7 customer support

- 30-day money-back guarantee

- Extensive library of free home-maintenance resources

- Additional on-demand home services available via AHS ProConnect

Cons

- Relatively short 30-day workmanship guarantee

- Website is somewhat user-unfriendly

Specs

- Service area: 49 states and Washington, D.C.

- Plans: ShieldSilver, ShieldGold, ShieldPlatinum

- Average monthly rate: $59.99

- Service fee: $75 to $125

- Workmanship guarantee: 30 days

- Claims process: Online, phone

Our Verdict: American Home Shield offers well-rounded home warranty policies that will likely appeal to a wide variety of homeowners. With extensive coverage options included in its different policy tiers—plus the option to purchase add-ons for more specialized protection—there’s a good chance homeowners will find the right coverage to meet their needs. American Home Shield’s home warranty costs are generally reasonable, but rates and fees will depend on the exact terms selected by the customer. Although American Home Shield supports online processes to get a quote, file a claim, or manage customer accounts, policyholders can reach out to a representative at any time for help with these tasks. That balance really highlights the core strength of American Home Shield: Every facet of the customer experience is competently executed, and there are no glaring drawbacks with its services that might raise a red flag for potential customers.

American Home Shield Review: Claims

American Home Shield bills itself as a leading home warranty provider that can help homeowners save money on repairs and keep their house or condo in good condition. The company is careful to make the distinction that it provides home warranties—not homeowners insurance—pointing out that this type of policy is meant to complement insurance rather than replace it. American Home Shield also champions the breadth of coverage that is included in its home warranty plans and assures customers that it will pay to replace any broken appliance or home system that cannot be repaired. Such lofty claims are no doubt appealing to many homeowners, but it’s important for a potential customer to look at the entire customer experience to better understand what to expect as a policyholder.

About American Home Shield

American Home Shield is a home warranty company that offers year-long service plans to help customers pay to repair or replace failing appliances and home systems. Covered units may include refrigerators, central air-conditioning systems, water heaters, and dishwashers, but that will depend on the type of policy the homeowner chooses. American Home Shield currently sells home warranties in 49 states and Washington, D.C.—the company does not operate in Alaska at this time. Customers may want to note that certain coverage options may not be available in all states in the company’s service area. Roof-leak protection, for instance, cannot be purchased by policyholders living in Hawaii.

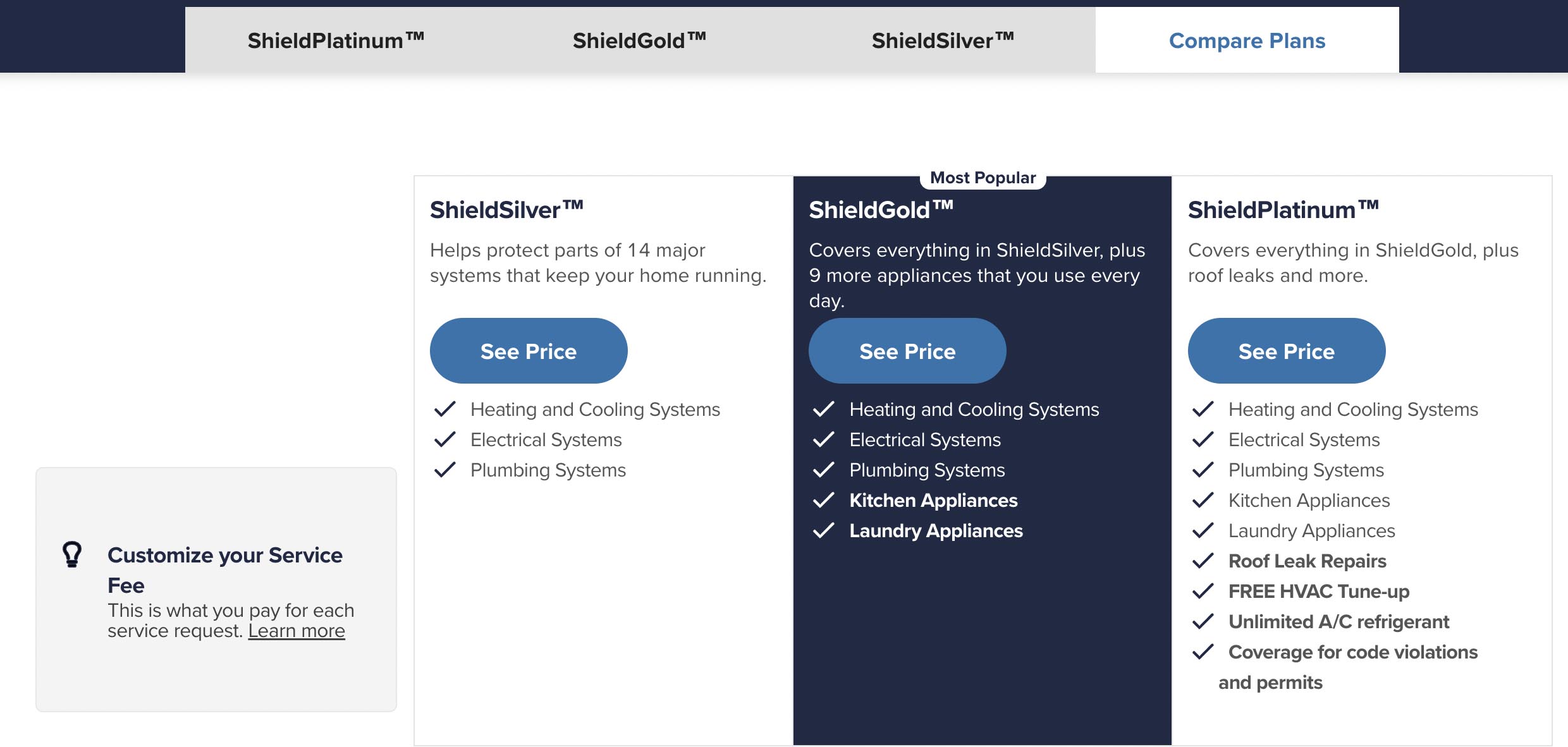

American Home Shield’s approach to home warranties is very similar to that of other companies in this space. Customers can choose from three service tiers—ShieldSilver, ShieldGold, and ShieldPlatinum—and purchase extra coverage through optional add-ons, if necessary. Price ranges across the different plans are pretty typical for the cost of a home warranty, neither significantly undercutting or exceeding the rates of many other providers.

When filing a claim on a broken appliance, customers will need to pay a technician fee before repairs can be completed. Again, this is not out of the ordinary, as such fees are typically assessed with any home warranty. Customers do have the option to select a lower technician fee at the time they purchase their policy, thereby lowering their out-of-pocket costs for repairs, but choosing a lower service fee will result in a higher monthly rate. That flexibility could be appealing to homeowners who want to customize their home warranty policy as much as possible.

Customers’ Online Experience

Is American Home Shield worth it for customers? The company’s services are heavily focused on the digital experience for its users. While homeowners can get a quote and file a claim over the phone, it may be more expedient to do both through the company website. When considering their policy options, customers can review a detailed table comparing coverage across each available home warranty plan. This makes it easier to see exactly what each policy tier can offer and then decide which plan makes the most sense given a homeowner’s particular needs.

Some online resources—information regarding available add-on options, for instance—may be difficult to find through the site’s home page. Because there is no search function built into the site itself, users may need to hunt around to find specific pages or resort to using Google. Despite those drawbacks, American Home Shield’s site is relatively easy to navigate, and pertinent information is clearly displayed so as to catch the eye of visitors.

Customers can also quickly switch to the Spanish-language version of American Home Shield’s site, allowing them to get a quote and buy a policy using either English or Spanish. Given the nuances of home warranty agreements, it may be a good idea to review terms and conditions in the language that a homeowner feels most comfortable using.

Home Warranty Plans, Coverage, and Caps

American Home Shield offers three tiers of service plans for customers to consider.

- ShieldSilver provides the most basic coverage and is primarily focused on major home systems, including heating and cooling, plumbing, and electrical systems.

- The next step up is ShieldGold, which protects the same home systems as ShieldSilver but adds coverage for kitchen and laundry appliances.

- The most comprehensive plan is American Home Shield’s ShieldPlatinum policy, which covers all of the appliances and home systems protected by the other plans but adds a number of additional coverage terms and perks for policyholders. ShieldPlatinum offers roof-leak protection, which would otherwise need to be purchased as an add-on, a free annual HVAC tune-up, and unlimited AC refrigerant refills. ShieldPlatinum policies will also provide up to $1,000 per year to bring home systems up to code.

Another benefit of opting for ShieldPlatinum is the higher coverage limit. Customers will receive up to $6,000 of coverage per appliance with this policy, compared with ShieldGold’s $3,000 coverage limit. American Home Shield’s contracts state that if the cost to repair or replace an appliance exceeds the plan’s limits, the company will provide a cash-out payment for the maximum coverage amount rather than pay the full repair cost.

ShieldSilver has no coverage limit on appliances since it does not protect kitchen or laundry appliances. For each of the three policy tiers, there is no set coverage limit for home systems, meaning customers will not have their repair request denied due to the total cost of service alone. Regardless of which plan a customer chooses, their policy will provide protection for older home systems; undetectable pre-existing conditions; improper installations; and malfunctions caused by poor maintenance, rust, or corrosion.

Plan Add-Ons

Once customers have selected which policy they want to purchase, they will have the option to buy add-on coverage at an additional cost. In some cases, coverage included in higher-tier policies can be purchased separately and added to lower-tier plans. Most notably, while roof-leak protection is a standard inclusion with the ShieldPlatinum plan, ShieldSilver and ShieldGold policyholders can purchase this coverage as an add-on.

While the coverage included in American Home Shield plans can be fairly extensive, customers may find their add-on options to be somewhat limited. This isn’t to say that anything noteworthy is missing from American Home Shield’s coverage—far from it, thanks to the generous coverage provided with the company’s higher-tier plans. But customers can only add a handful of different policy options to their home warranty.

In addition to roof-leak protection, American Home Shield offers four main policy add-ons. It’s easy to see why some of these add-ons are not included in basic policies, as they will only apply to very specific scenarios. For instance, customers who have guest houses or rental units on their property can purchase separate coverage for guest units. This add-on only protects rental units under 750 square feet, so customers will want to be cognizant of these size limitations when purchasing extra coverage. Policyholders can also purchase additional coverage for septic pumps, well pumps, and both inground and above-ground pools.

Another add-on option that homeowners may be interested in is American Home Shield’s Electronics Protection Plan, which protects against power surges, defects, mechanical failures, and electrical issues for TVs, laptops, computers, tablets, video game consoles, and other home electronics.

Home Warranty Plan Pricing, Fees, and Discounts

Prices for American Home Shield warranties can vary somewhat significantly depending on a variety of factors. The most important consideration to cost is the amount of coverage that a customer purchases. With three policy tiers to choose from, and each at a different starting price point, starting rates will depend on the plan that a customer selects. A homeowner who doesn’t need a home warranty to protect their appliances can save money by buying a ShieldSilver plan for their major home systems alone. Purchasing add-ons will further influence the total cost of coverage as well. According to the company’s website, these add-ons could cost as little as $50 or as much as $258 per year.

American Home Shield notes that the size of the home will impact the total cost of coverage too. Because every policy includes coverage for home systems like ductwork, it makes sense that homes with more square footage would be more expensive to cover with a home warranty. It’s worth customers noting that an American Home Shield warranty starts out at $39.99 per month, but rates for higher policy tiers will cost much more.

The up-front costs of purchasing a policy aren’t the only expenses that homeowners will want to account for when considering a home warranty plan. No matter what company or policy a homeowner chooses, they’ll need to pay a technician or service fee when the time comes to file a repair request. American Home Shield gives customers the option to choose from $75, $100, and $125 service fees. In addition to impacting the total cost of coverage, the technician fee also affects policy rates. Selecting a higher technician fee will give customers lower monthly rates in return, so this is another important factor to consider when choosing policy terms.

Discount opportunities on an American Home warranty are fairly limited. Customers who buy a second policy to cover another property can receive $50 off their additional home warranty. In addition, the company will give a $25 Amazon gift card to members who refer a new customer. American Home Shield also runs an exclusive appliance discount program that allows members to replace their appliances with name-brand products at discounted prices. Although this program may be appealing in its own right, it doesn’t really affect either the up-front investment or the total cost of coverage.

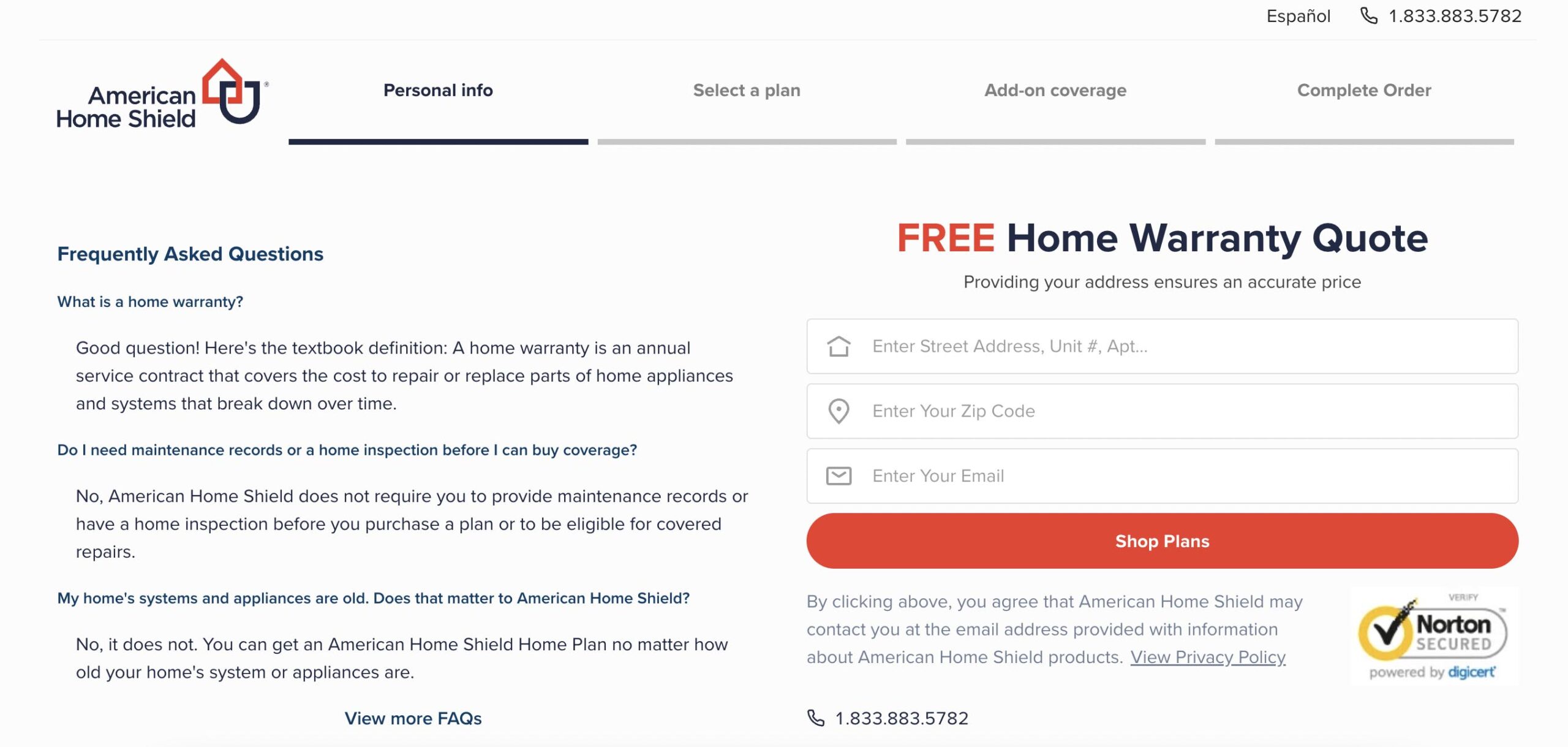

Getting a Quote

American Home Shield makes it easy for homeowners to get a quote on a new home warranty online or over the phone. The quickest way to get a quote is to go through the company’s website and click on the “Shop Plans” button at the top of the page. After providing their address and email address, homeowners can compare the three warranty policies available to them and find the plan with the right amount of coverage. They can also select one of three technician fee options and see how their choice impacts the monthly cost of coverage for each policy tier.

Once prospective customers have picked their policy and service fee, they will have the opportunity to add optional coverage to their home warranty plan. The monthly rate of each add-on is clearly indicated so homeowners can decide if the extra coverage is worth the price increase. Finally, customers will land on the checkout page, which breaks down the total cost of their home warranty with all of the terms and conditions they have selected. If they decide to purchase a policy with American Home Shield, customers can buy a plan directly through the website using a credit card, bank transfer, or PayPal account.

Despite requiring users to provide their email address at the start of the process, American Home Shield does not send a copy of the quote once it is completed. The only way to view a home warranty quote is by going through the process again and getting back to the checkout page. Because the entire process only takes a couple of minutes at most to complete, this shouldn’t be too onerous for customers who want to review their quote or change the terms of their potential policy, but it is an additional step to take.

Filing a Claim

American Home Shield customers can file a claim either over the phone or online through the company website. After logging into their member account, policyholders can request service by submitting a claim and listing the covered appliance or home system in need of repair along with a description of the issue being experienced. Customers will need to pay their technician fee up front when submitting a claim before their repair request can be confirmed. Some homeowners may prefer to go through this process over the phone with a representative since it could be easier to explain any issue that requires repair.

Once the claim has been received, American Home Shield will assign the job to a local contractor from its network of preferred service technicians, providing details about the repair request. The home warranty company will also give the technician’s contact information to the customer so they can be contacted directly to schedule an appointment. Although this won’t always be the case, technicians may set up an initial virtual service call so the customer can show them a video of the broken appliance or malfunctioning home system. This virtual assessment can give contractors a better understanding of the issue so they can come prepared to fix the problem without requiring follow-up visits.

After the technician has diagnosed the problem, American Home Shield will review the inspection report and check that the issue is covered under the homeowner’s warranty policy. If so, then the contractor will go ahead and make the necessary repairs or replace the broken appliance with a new unit.

American Home Shield’s workmanship guarantee gives customers 30 days to report any issue they experience after repairs have been completed. The company notes that this guarantee only extends to issues included in the original claim and diagnosed by the contractor during the inspection. Homeowners may want to note that 30 days is relatively short for a workmanship guarantee and that any additional follow-up work required outside of this period will necessitate another technician service fee, which could prompt them to look elsewhere for their home warranty needs.

Customer Service Experience

American Home Shield puts a great deal of effort into providing a strong customer experience. Customers who have questions about their home warranty or want to check the status of a submitted claim can dial the American Home Shield phone number and talk to a representative at any time. The American Home Shield customer service line is open 24/7 and staffed by agents at all times who can respond to questions and concerns.

American Home Shield has also made it easy for customers who want to cancel their policy to do so without delay by speaking to an agent over the phone and requesting a cancellation. Customers who cancel their home warranty within the first 30 days of coverage will receive a full refund. After that, any refunds will be prorated based on the amount of time remaining on the policy. Although there’s no cancellation fee, the company may deduct certain administrative fees when processing a refund, but that will be determined on a case-by-case basis.

Making changes to an existing policy isn’t always quite as easy, however. Customers have the option to amend their home warranty during the first 60 days of coverage, but they will not be able to switch plans, change their technician fee, or add extra coverage after that point.

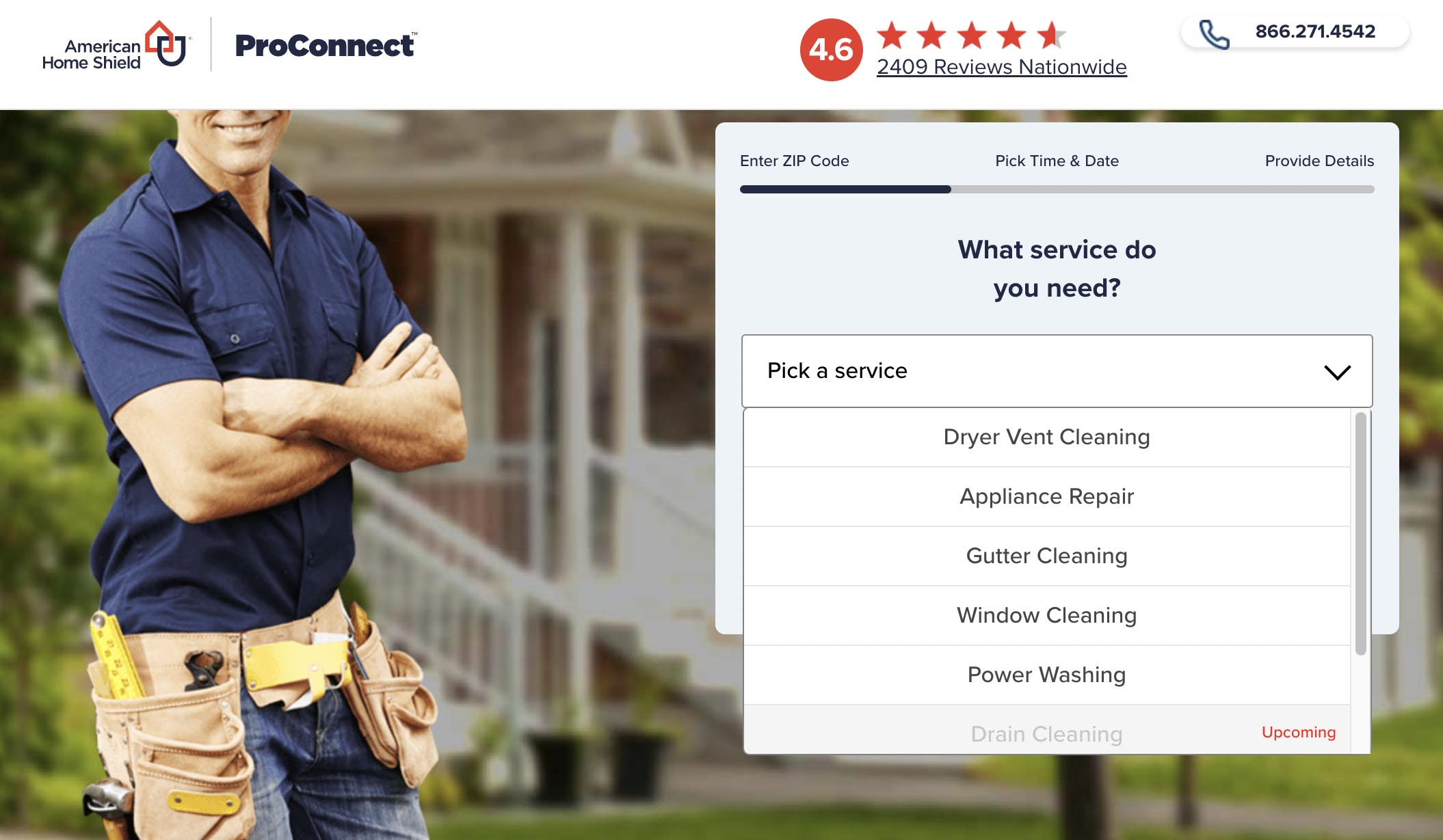

American Home Shield ProConnect

Not all repairs or home services can be covered with a home warranty, but American Home Shield has launched the ProConnect service to help fill some of those coverage gaps. Customers can request a variety of repair jobs and home services, including plumbing repairs, carpet cleaning, and power washing, through the ProConnect platform. Service availability may depend on the customer’s location, however. Plumbing services, for instance, may be available in some ZIP codes but not others.

Arguably the most appealing aspect of this program is the speed and convenience with which customers can schedule appointments. Customers select the type of work they need from different service categories, with the price for each job clearly indicated before an appointment is scheduled. Listed prices are all-inclusive, as well, so homeowners don’t need to worry about incurring additional charges or fees after work has been completed.

Because the company maintains such a large network of approved contractors, American Home Shield can match homeowners with a local technician or handyman in short order. According to the company, a contractor could arrive at a customer’s home in as little as an hour. This may help homeowners save time looking for the right contractor or technician to fix any issues they’re experiencing. ProConnect is also very transparent about the quality of work provided by different contractors, allowing customers to post reviews and rate technicians. When a job is completed, customers can pay for any repairs or services online with either a credit card or electronic check.

American Home Shield Home Warranty Reviews by Customers

Customer reviews for American Home Shield tend to vary pretty significantly. Reviewers on Consumer Affairs have left overwhelmingly positive feedback for the company, with many highlighting how quick representatives are to respond to repair requests and schedule appointments. They also mentioned the high quality of workmanship on repairs, along with the expertise and professionalism exhibited by the technicians hired through American Home Shield.

User reviews submitted to the Better Business Bureau were more of a mixed bag. Some comments speak to the company’s excellent customer service—in particular, the responsiveness of American Home Shield representatives. Other customers reported more negative experiences, which often focused on either repair work not being approved by the company or repairs taking longer than expected due to delays receiving necessary parts.

Several Trustpilot reviewers have reported similar concerns about protracted repair work while technicians waited for the right part to be delivered. These complaints seem more focused on supply chain issues that would be out of the hands of any home warranty company and are not necessarily specific problems related to American Home Shield. In addition, complaints about rejected claims could be the result of policyholders misunderstanding the coverage included in their home warranty. In some cases, negative American Home Shield reviews referred to coverage as “insurance,” which may indicate that the reviewers did not fully understand the purpose of a home warranty.

How American Home Shield Stacks Up to the Competition

American Home Shield is an all-around good option for home warranties with no major weaknesses or drawbacks that would give a homeowner pause. The coverage included in its policies is fairly comprehensive and may include protection that would typically only be offered as a separate add-on. For instance, both Choice Home Warranty and Liberty Home Guard list roof-leak protection as an add-on option to be purchased at an extra cost. Some companies, like Home Warranty of America, may not cover roof leaks at all. But American Home Shield offers this coverage as part of a standard ShieldPlatinum policy.

American Home Shield’s service area, average rates, technician fees, and claims process all align with industry standards. One area where the company may stand out, however, is its coverage limits. The combination of unlimited coverage for home services and $6,000 for each appliance with a ShieldPlatinum policy—not to mention $1,500 on roof-leak protection—could mean that American Home Shield customers are less likely to pay out of pocket for any repairs they schedule, less the technician fee.

When comparing the best home warranty companies, homeowners may also be interested in American Home Shield’s 24/7 customer support and 30-day money-back guarantee. This may alleviate any concerns about buyer’s remorse or needing to schedule repair work on short notice. The more specialized add-ons available for purchase may appeal to some homeowners as well. Optional add-ons like guest unit and pool coverage could be extremely useful in the right circumstances, and not all home warranty companies will offer this kind of protection in any capacity.

Is American Home Shield Worth It?

Buying a home warranty from American Home Shield may be a good option for homeowners who would like to avoid paying entirely out of pocket to fix or replace any appliances and home systems that may break down. With its three policy tiers and various add-on options, American Home Shield offers fairly extensive home warranty coverage, and customers have some flexibility to find the right combination of terms and options to suit their needs.

Homeowners who only want a home warranty to cover their home systems like HVAC systems and ductwork may find that the ShieldSilver is the best option available from American Home Shield. Those who need protection for their appliances may be better served by purchasing a ShieldGold or Shield Platinum policy. The ShieldPlatinum plan may make the most sense for homeowners looking for extra benefits such as money to bring home systems up to code, repair roof leaks, and give their HVAC systems a tune-up.

On the other hand, homeowners who aren’t particularly concerned about the cost to pay for repairs when the need arises may not find much value in this or any home warranty. That may also hold true for homeowners who have extended warranties already attached to their most expensive appliances and home systems, as coverage may overlap between those warranties and any separate home warranty they might purchase.

Although discount opportunities are very limited, American Home Shield’s monthly rates and technician fees are pretty reasonable for a home warranty. If customers decide later on that they don’t need the protection of a home warranty, they can always cancel their policy and receive at least a partial refund. Despite their strengths, many home warranty companies have glaring weaknesses, but that’s not the case with American Home Shield. The provider offers very well-rounded coverage at a price that is comparable to other home warranties. So, is American Home Shield worth it? For many homeowners, this home warranty could be worth it to help them protect their home systems and appliances in the event they need to be repaired.

We independently reviewed this service by weighing the company’s claims against first-hand experience with its professionals. However, due to factors such as franchising, human error, and more, please note that individual experiences with this company may vary.