We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Real estate transactions can seem daunting, especially for first-time homebuyers. You want information that helps you buy or sell your home fast, and online searches can yield overwhelming results. You don’t have countless hours to go down the Google rabbit hole.

Real estate deals involve researching market trends, browsing listings, searching for a reputable real estate professional, calculating potential mortgages, and more. From a new family home to an investment property, today’s technology can help make the buying or selling process a little less intimidating.

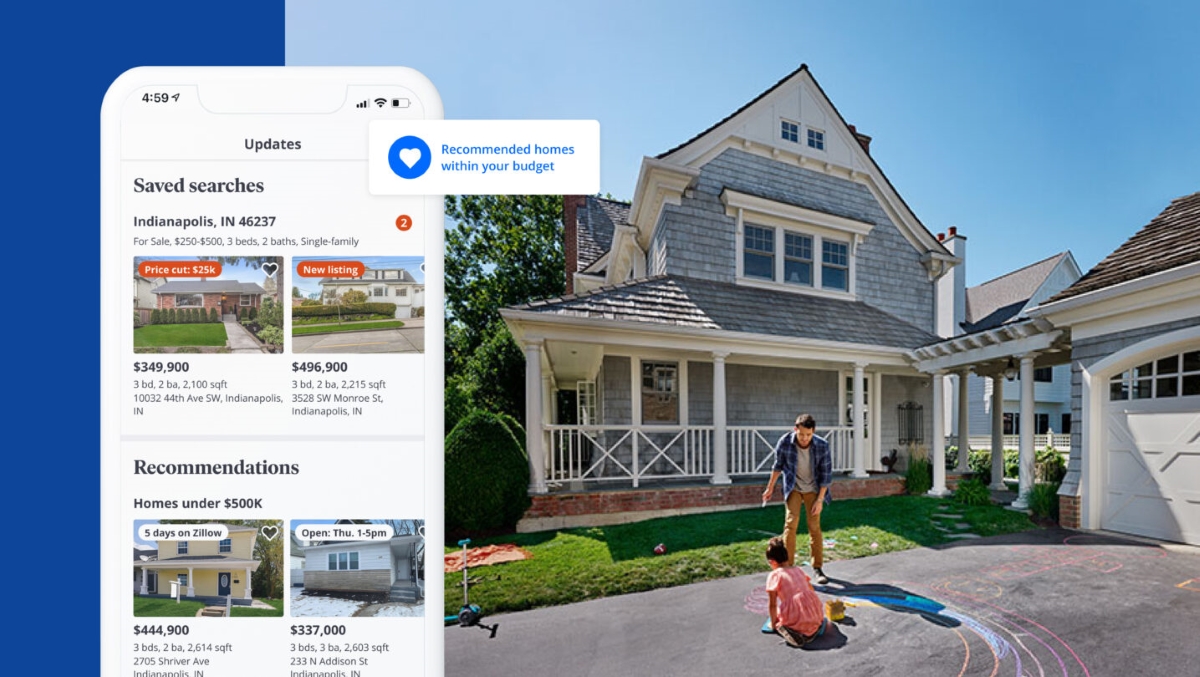

1. Zillow

Since its 2006 launch, Zillow has become a go-to source for all aspects of real estate. Users can search more than 110 million homes in Zillow’s database (including properties both on and off the market), find an agent, calculate mortgages, peruse design galleries, and get a “Zestimate,” or price estimate, on any home. Zillow’s search feature is especially detailed, making it easier for homeowners to find their dream home with the click of a mouse. What’s more, the Seattle-based website has two dozen apps, giving users access across multiple platforms.

RELATED: 12 Ways Buying a Home Has Changed Over the Past 50 Years

2. Trulia

According to its website, Trulia “goes beyond the typical listings” to inform users about properties and neighborhoods. Like Zillow, it’s a great tool for browsing homes for sale and researching market information and mortgage rates. But Trulia also gathers data on various lifestyle factors in a community, like crime, school districts, market trends, commute estimates, “walk scores” that assess on-foot accessibility, and demographics. This information is indispensable for those relocating to an unfamiliar area. If you’re itching to immerse yourself in real estate on the go, simply download Trulia’s easy-to-navigate app.

RELATED: 7 Unconventional Ways to Sell a Home

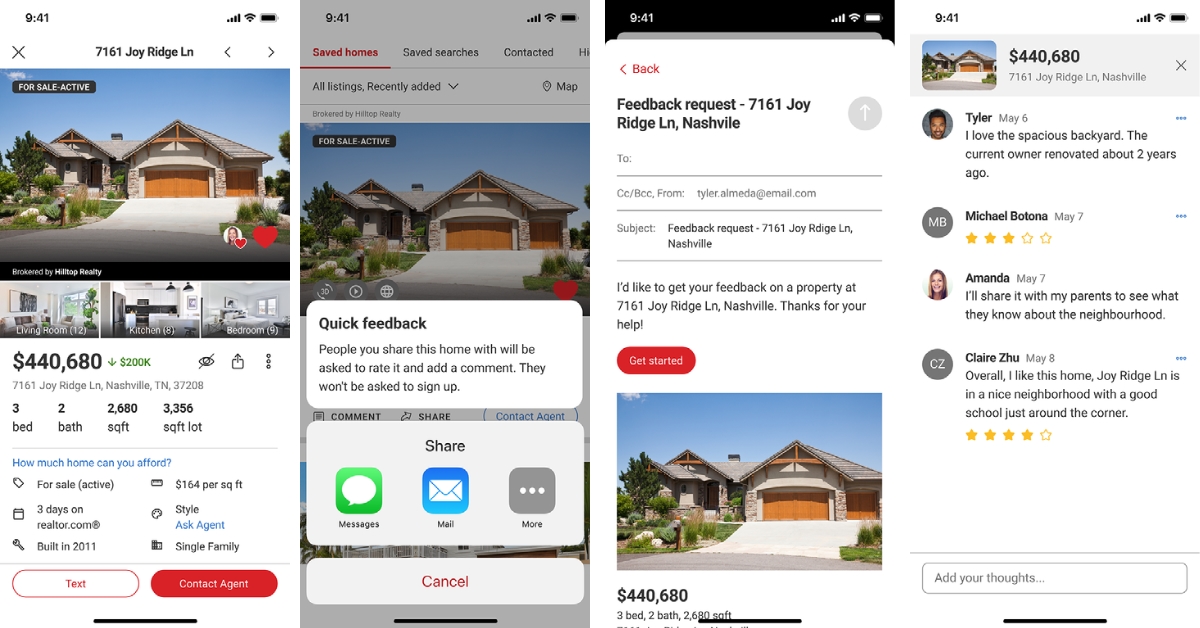

3. Realtor.com

Sponsored by the National Association of REALTORS®, Realtor.com has provided professional expertise to homeowners, buyers, and sellers since 1994. In fact, it was one of the first online real estate tools! Aside from hosting a database of listings and housing information, Realtor.com encourages users to connect with more than a million local real estate agents, all of whom belong to the National Association of REALTORS®. Users can also track their home valuation, equity, and mortgage.

RELATED: 11 Sneaky Ways to Save When Buying a Home

4. Apartments.com

Are you looking to rent instead of buy? Then head over to Apartments.com, which connects potential renters with apartments across the country. Narrow down the millions of listings with specific criteria; for example, search by neighborhood, price range, apartment type, commute time, pet policies, square footage, amenities, and more. Some rental listings even have virtual tours! Those who prefer mobile browsing can download the iOS and Android apps for Apartments.com.

RELATED: The State of Renting: What All Tenants and Landlords Need to Know

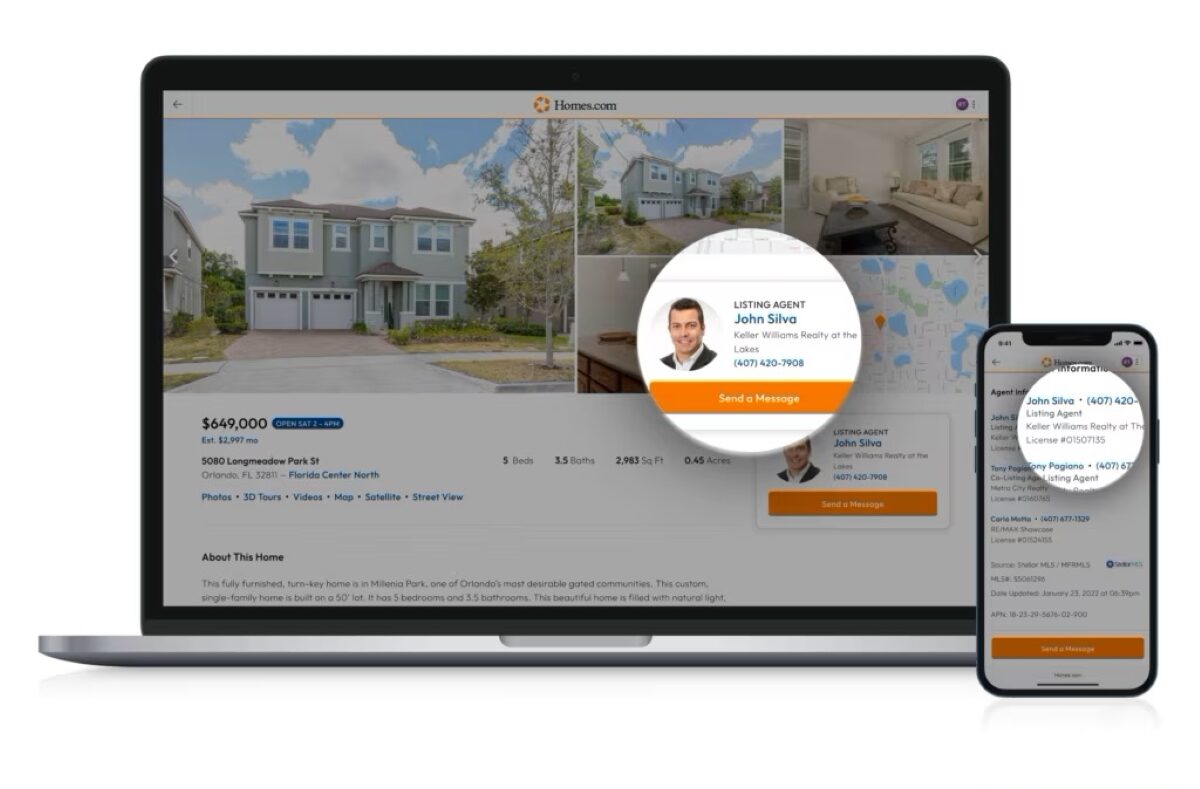

5. Homes.com

If you’re in need of a wide range of resources, consult Homes.com, which actually began as a real estate magazine. With more than 4 million listings, Homes.com is a handy tool for those looking to buy or rent property. But users can also search prices on homes recently sold in a community, find real estate professionals, and read informative how-to articles about buying and selling homes.

RELATED: 14 Telltale Signs That a House Might Be Going on the Market

6. Curbio

Particular renovations and updates can increase the selling price of your home exponentially. If you’re not handy, don’t have the time, and want to get these projects done quickly and professionally, check out Curbio.

Let the team at Curbio know about your project(s). They’ll prepare an estimate, assign you a project manager, and set up a dashboard where you can track progress and communicate with the team. They work to get your home on the market as fast as possible, and you don’t pay a thing until your home sells.

RELATED: Will That Renovation Really Increase Your Home’s Value?

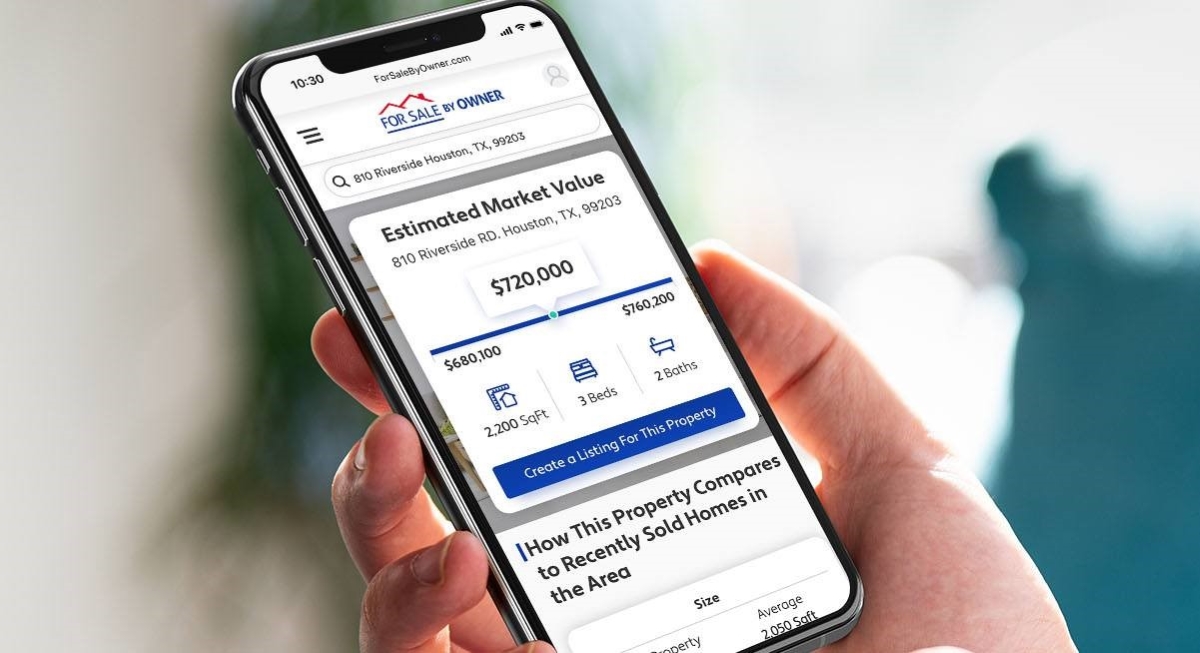

7. ForSaleByOwner.com

Not every seller wants to hire a professional real estate agent. If you’re forgoing a broker, ForSaleByOwner.com is the perfect guidebook, as evidenced by its tagline of “All You Need to Know to Sell Like a Pro.” The website helps sellers price, list, market, and show their homes. On the other hand, buyers can leaf through listings, find market information, compare home values, and more. Keep in mind, however, that this service isn’t free; the most popular plan requires a one-time payment of $349.

RELATED: What is a Real Estate Agent, and Do I Need One?

8. Redfin

Residential brokerage company Redfin also runs a well-regarded real estate website. Its home search tool is extensive, giving users the option to search for fixer-uppers or homes with a view. But Redfin’s best feature is its ability to connect buyers and sellers with real estate agents. Scheduling a tour and finding open house information has never been easier. Redfin’s “Last Call” keeps you informed during bidding wars, while “Price Whisperer” gives sellers real-life feedback on their desired listing price.

RELATED: 7 Signs Starter Homes May Be a Thing of the Past

9. Thumbtack

The right staging helps a potential buyer visualize a home’s potential and picture themselves there. A stager helps make your home marketable, often helping fetch more and higher offers.

Thumbtack is a great resource for sellers seeking home staging services (and other contracting services too). Use their database to search for home stagers in your area. The site generates results that meet your criteria and offers company profiles and verified reviews so you can feel confident about who you’re hiring.

RELATED: Buyer’s Guide: The Best Home Staging Services

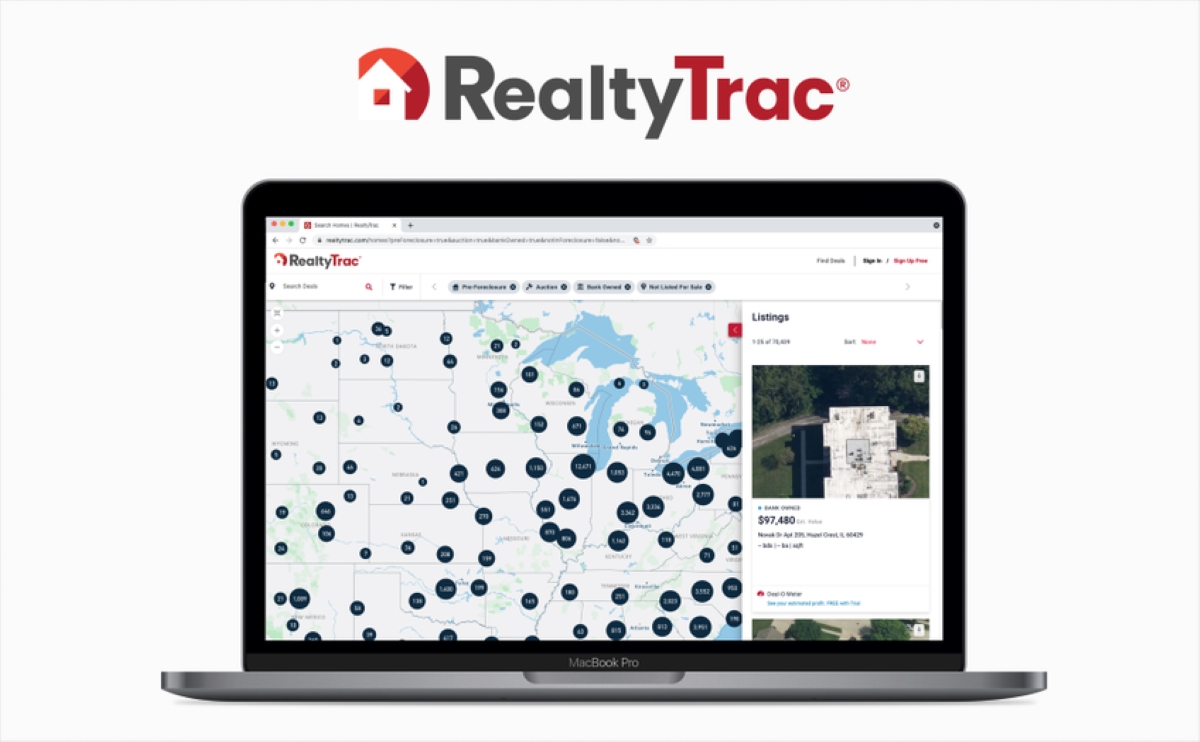

10. RealtyTrac

Are you looking to channel your inner Chip and Joanna Gaines by purchasing a fixer-upper? Then consider getting a seven-day free trial to RealtyTrac, which lists more than 120 million foreclosed and bank-owned homes. You’ll also gain access to auction dates and locations, neighborhood data, property information, and real estate guides. If you decide you like the website, subscriptions cost $49.95 per month. RealtyTrac is the perfect place to find a bargain!

RELATED: 10 Things I Wish I Had Known Before I Bought a Foreclosure

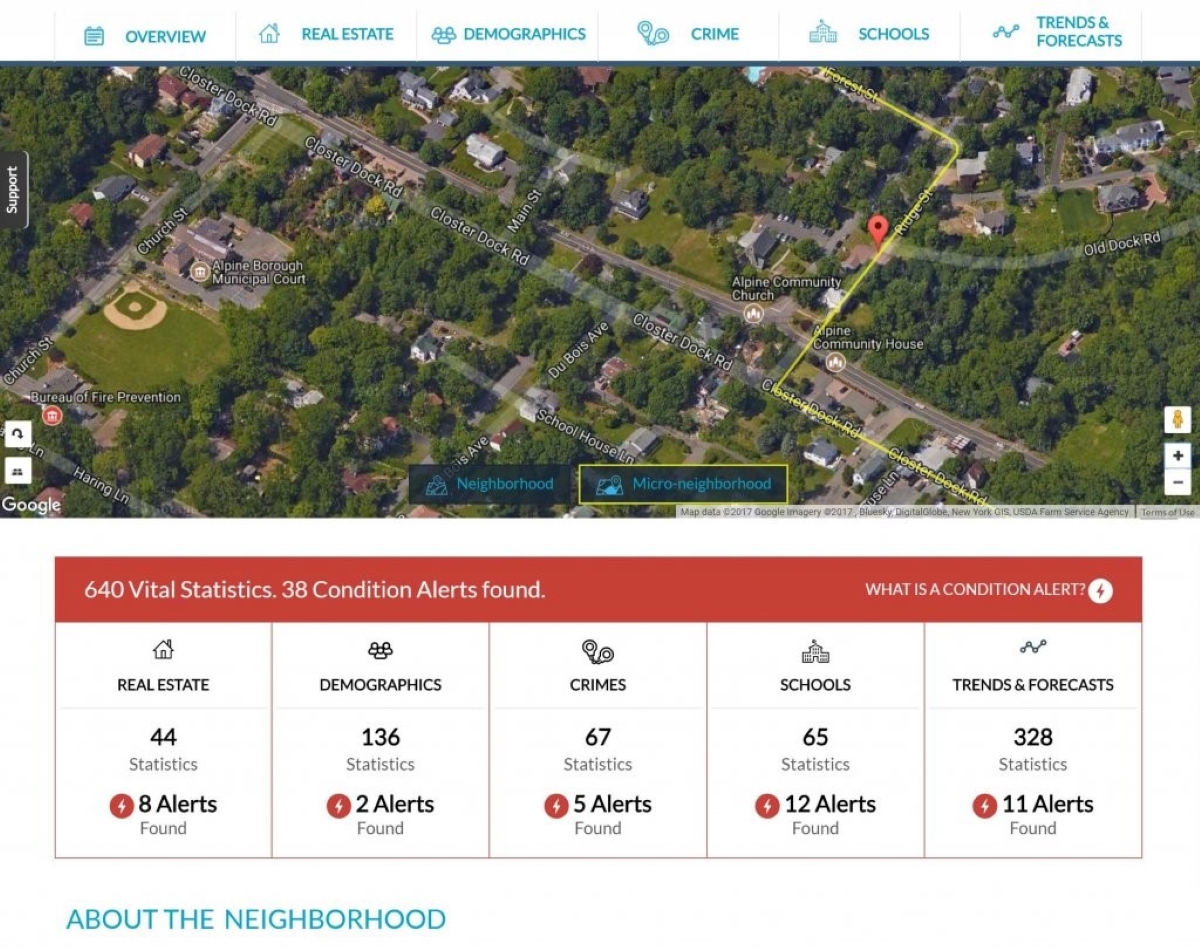

11. Neighborhood Scout

Relocating to a new neighborhood can be tough, especially if you’re unfamiliar with the area. NeighborhoodScout comes to the rescue, providing detailed real estate data on communities across the country, allowing you to compare different areas with ease. Use the website to learn about housing prices, neighborhood characteristics and demographics, school districts, crime rates, trends, and more. Subscriptions range from $39.99 to $199.99 per month.

RELATED: Solved! What Does “En Suite” Mean?

12. Opendoor

If you’re overwhelmed with the to-do list of selling your place—listing, cleaning, renos, showings, and more—Opendoor may be the right fit for you. You won’t have to deal with any of these things.

Through their mobile-friendly site, you answer some questions and upload a video walkthrough of your home, and often within 24 hours, you receive a competitive all-cash offer. Unlike traditional deals that may be delayed or fall through, Opendoor makes selling a home as stress-free as possible.

While mainly geared toward sellers, Opendoor helps buyers find their next home too!

RELATED: Find the Right Realtor: 17 Tips from Happy Homeowners

13. The Mortgage Reports

The financing side of buying or selling a home can feel intimidating. The Mortgage Reports is an excellent resource to access today’s mortgage rates, calculators, and other tools and guides to help understand the money side of real estate transactions. You’ll gain a lot of knowledge just by reading through their articles, including how to make a winning offer on a house.

Whether you want to purchase, refinance, or get a home equity loan, The Mortgage Reports contain plenty of educational information. They can also connect you with lenders if you want to learn more about your options.

RELATED: Will Mortgage Rates Go Down This Year?

14. Airbnb

Where do you plan on going once your house sells? If the possession dates are not in your favor, you can rush to buy another home, which is not ideal, or move into a short-term rental. Choose the latter and continue your search for your new home without settling for less than what you want.

Known for its short-term bookings, Airbnb also offers monthly rentals so you can move on your own schedule. Stay a month or more in a comfortable setting while you sort out your next long-term dwelling.

RELATED: 18 Weirdly Awesome Summer Vacation Rentals on Airbnb

15. Beycome

A new player in the for sale by owner (FSBO) game is Beycome. Keep an eye on this promising company! It offers a modern way to buy or sell a home without engaging the services of a realtor.

Using the site’s tools, buyers can browse listings, schedule visits, offer and negotiate, close the deal, and receive approximately 2 percent cash back (Beycome takes roughly 1 percent).

Sellers submit their property photos and details, receive professional marketing materials, and accept, counter, or reject offers through the site, saving thousands in the process.

Best of all, the digital paperwork is prepared in regulation with your state’s laws, and you have Beycome’s real estate experts available to help if you need them.