We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

The mortgage industry can be a bit old-fashioned at times, slow to adjust to broader trends. Case in point: the almost glacial speed with which some lenders have embraced digital platforms over the past decade-plus. That’s not the case with Rocket Mortgage, though. From its inception, the lender’s singular focus has been to provide borrowers with an easier way to apply for and secure financing to purchase a home or change the terms of their existing mortgage with the help of digital solutions.

The company’s dedication to online processes may make it a welcome addition to the mortgage industry for prospective home buyers who would rather manage their loan online than sit down and talk to a loan officer face to face. Does Rocket Mortgage strike the right balance between convenience and effectiveness, giving borrowers a more user-friendly journey through the mortgage process without sacrificing the strong quality control standards that this industry demands? Our Rocket Mortgage review takes a closer look at what this lender has to offer and if it makes sense for people looking to take out a home loan or refinance to work with Rocket.

See more of the best mortgage lenders.

At a Glance

Rocket Mortgage

Pros

- Quick online prequalification

- Lengthy 90-day rate-lock period

- Convenient mortgage management via mobile app

- Responsive online chat staffed by live agents

Cons

- Somewhat limited ARM options

- Somewhat misleading mortgage rate calculator

Specs

- Application process: Online, phone, app

- Prequalification process: Online, phone

- Loan types: Fixed rate, ARM, VA, FHA, jumbo

- Loan terms: 15 or 30 years on fixed-rate loans; 7 or 10 years on ARMs

- Closing time frame: 30 to 45 days

Our Verdict: Rocket Mortgage offers a relatively quick and streamlined process to obtain financing for a home purchase or to refinance an existing home loan. The company’s user-friendly online workflows stand out in an industry that’s still catching up to the digital revolution. Although rates and fees will vary depending on the borrower’s specific financial situation, Rocket’s rates are comparable to industry averages and should be competitive with many other lenders. Eligibility requirements are similarly in line with industry standards, and borrowers with stable finances should be able to qualify for a variety of loan options.

Rocket Mortgage Review: Claims

Rocket Mortgage positions itself as a cutting-edge company shaking up a mortgage industry that’s set in its ways. Most notably, the lender has completely removed local loan officers from the mortgage process. Although Rocket Mortgage employs many knowledgeable and experienced loan officers, those staff members do not operate out of local branch offices. Rather than using traditional mortgage processes that may be slower to respond to customer needs, Rocket focuses on digital workflows to manage every stage of the loan journey, from application to closing.

In general, Rocket presents a commitment to a strong customer experience. While some lenders may try to entice borrowers with the promise of low interest rates, Rocket Mortgage stresses the importance of finding the right loan terms to suit every situation. The company has also rolled out new offerings to respond to shifting mortgage industry trends. For instance, a 90-day rate-lock option could help borrowers avoid rate hikes during the approval process.

About Rocket Mortgage

Rocket Mortgage is a lender specializing in home loans, offering different types of financing to help people afford to buy a new home. It also refinances existing home loans so borrowers can change their loan terms, possibly lowering their monthly payments and interest rates in the process. It’s important to note that Rocket is a mortgage lender rather than a mortgage broker, meaning that borrowers will receive a loan directly from the company. Rocket also maintains its own in-house team of underwriters, which can help minimize delays in the loan review process.

Borrowers with a cursory understanding of Rocket’s history may still wonder, what is Rocket Mortgage as it relates to Quicken Loans? Rocket was initially created by and spun off from Quicken Loans to manage the company’s digital mortgage business. Although it started out as a subsidiary of Quicken Loans, Rocket Mortgage has had a meteoric rise to the top of the mortgage industry since its inception in 2015. With digital mortgage processes becoming more normalized across the industry, business has boomed for the nascent organization, and its brand has quickly grown in stature and recognition. So much so, in fact, that Quicken Loans officially changed its name to Rocket Mortgage in 2021.

The distinction between the two brands may be confusing at times. What is Quicken Loans, for instance? Quicken Loans has been a long-standing traditional mortgage lender. It was originally the parent company of Rocket Mortgage before rebranding under the Rocket Mortgage name. Who owns Rocket Mortgage, then? The lender now exists under the parent company, Rocket Companies, which also owns sister companies such as Rocket Auto and Rocket Loans.

Some remnants of the Quicken Loans brand still exist. Customers who previously took out a loan from Quicken Loans will likely continue to see that brand name listed on their loan documents. For instance, borrowers who are ready to make a final payment on their home loan may receive a Quicken Loans payoff request letter. For all intents and purposes, though, Rocket Mortgage and Quicken Loans are one and the same. Quicken Loans rates and Rocket interest rates are identical, and no matter which brand site borrowers go to, they will be funneled into Rocket Mortgage’s application process when they go to apply for a loan.

Rocket Mortgage claims to be the largest mortgage lender in the country, although the exact criteria it uses to substantiate that position is unclear. Determining the largest lender could be based on the number of loans originated or the amount of funds provided to borrowers for financing. Even so, there’s no denying Rocket’s stature in the mortgage industry, especially when combined with the successful track record of Quicken Loans. The lender maintains a nationwide footprint, extending loans in all 50 states and Washington, D.C., so eligible borrowers will be able to get financed regardless of where they live in the U.S.

How Does Rocket Mortgage Work?

Rocket Mortgage’s website notes that the company was created from the outset to provide an end-to-end mortgage experience that’s as quick and convenient as possible. To that end, the company is heavily focused on digital processes, allowing customers to apply for loans, provide supporting financial documents, correspond with loan officers, and monitor the application workflow entirely online.

Once a loan has been approved, closed, and funded, the borrower will be responsible for making monthly payments until the full amount is repaid. Borrowers can manage their loan by creating an online account with Rocket Mortgage or downloading the company’s mobile app. They are also able to view important documents such as tax statements and insurance forms, check their repayment progress, and verify past payments on their mortgage. As far as Rocket Mortgage payment options are concerned, borrowers can set up automatic payments, transfer money directly from their bank account, or mail a check or money order.

It’s very possible that the Rocket Mortgage company will sell a borrower’s mortgage on the secondary market as part of a mortgage-backed security. This is entirely normal for mortgage companies, as secondary market transactions are a major source of income for them. Even if a mortgage is sold in this fashion, Rocket may retain servicing rights on a home loan, so the borrower would continue making payments to Rocket Mortgage rather than another institution.

Borrower Requirements

Borrowers will need to meet certain criteria to qualify for a Rocket loan, including standards for credit scores, debt-to-income (DTI) ratios, and income. Lenders typically weigh these factors on a case-by-case basis, so they tend to avoid publishing any set borrower requirements. Rocket Mortgage is no different in this regard, but borrowers should probably expect to need at least a 620 credit score to qualify for most types of financing. However, they may qualify for an FHA loan with a credit score as low as 580, but Rocket will consider the applicant’s entire financial situation before making a decision.

When it comes to debt, Rocket Mortgage recommends that prospective home buyers have a DTI ratio of no more than 45 percent. In other words, borrowers should not spend more than 45 percent of their monthly gross income on recurring debt obligations such as rent, car loans, student loans, or credit card bills. Rocket’s underwriters will also want to verify an applicant’s income, employment, and financial assets. In particular, the lender prefers borrowers who can show proof that they have a stable work history of 2 years or more. Again, though, borrower requirements are not always set in stone, and applications meeting this criteria may be approved or denied in response to other factors and considerations.

Loan Options and Terms

Rocket Mortgage provides a fairly robust selection of loan products for borrowers to consider. Conventional home loan options include both fixed-rate and adjustable-rate mortgages (ARMs). Borrowers can apply for 15-year or 30-year home loans, which is typical for this type of mortgage. ARM options may be a bit limited, as home buyers can only choose from 7-year and 10-year ARMs. Borrowers looking for a 5-year ARM won’t be able to get a mortgage with those financing terms with Rocket.

Eligible borrowers may be able to get financing through government-backed loans, including FHA loans. These loans may be appealing to first-time home buyers due to the relatively lenient borrower requirements. Rocket Mortgage is also a VA-approved lender, so it can offer VA loans to borrowers who are active or retired service members of the armed forces.

Non-conforming home loans may be an option as well, as Rocket offers jumbo loans for loan amounts that exceed the federal government’s conforming loan limits. Rocket Mortgage has not historically offered home equity loans, but that’s changed as of August 2022. The lender now offers home equity loans to eligible borrowers. Home equity lines of credit (HELOCs) are still off the table, though. If homeowners want an alternative approach to tapping into their home equity, Rocket offers cash-out refinances, which would require borrowers to replace their existing mortgage with a new one at a new interest rate.

Mortgage Rates, Fees, and Discounts

Mortgage rates are constantly shifting on a daily basis—and are determined in part by a borrower’s financial circumstances—so it’s difficult to say exactly what interest rate a borrower may be offered. Such ambiguity may make borrowers wonder, “Is Rocket Mortgage a rip-off?” Not at all; Rocket Mortgage interest rates are often comparable to industry averages published each week by Freddie Mac. It’s worth noting that Rocket Mortgage makes no promises that borrowers will get the lowest rates with its financing options—in fact it urges prospective home buyers to look beyond mortgage rates alone to find the right home loan for them.

Rocket Mortgage expects borrowers to make a down payment that’s at least 3 percent of the home’s selling price, but such a low down payment amount is typically reserved for specific loan products like FHA loans. If borrowers put less than 20 percent of the purchase price forward for their down payment, they will likely need to pay private mortgage insurance (PMI). This extra fee could increase a borrower’s monthly payment by as much as 2 percent.

Although applying for a home loan is free, borrowers will need to pay certain closing costs and other expenses such as appraisal fees. According to Rocket Mortgage, closing costs typically run anywhere from 3 percent to 6 percent of the home’s selling price, but the exact amount will be detailed in the closing documents. Rocket Mortgage doesn’t offer promotional discounts, but borrowers can reduce their interest rate by purchasing mortgage points. Borrowers need to pay 1 percent of their loan amount in exchange for a discount point, which will lower their interest rate by as much as 0.25 percentage points. Home buyers may also be able to temporarily reduce their interest rate on a new purchase with Rocket’s Inflation Buster service. This buy-down program allows eligible borrowers to lower their interest rate by 1 percent at the outset of their home loan, lowering their initial monthly payments.

Application Process

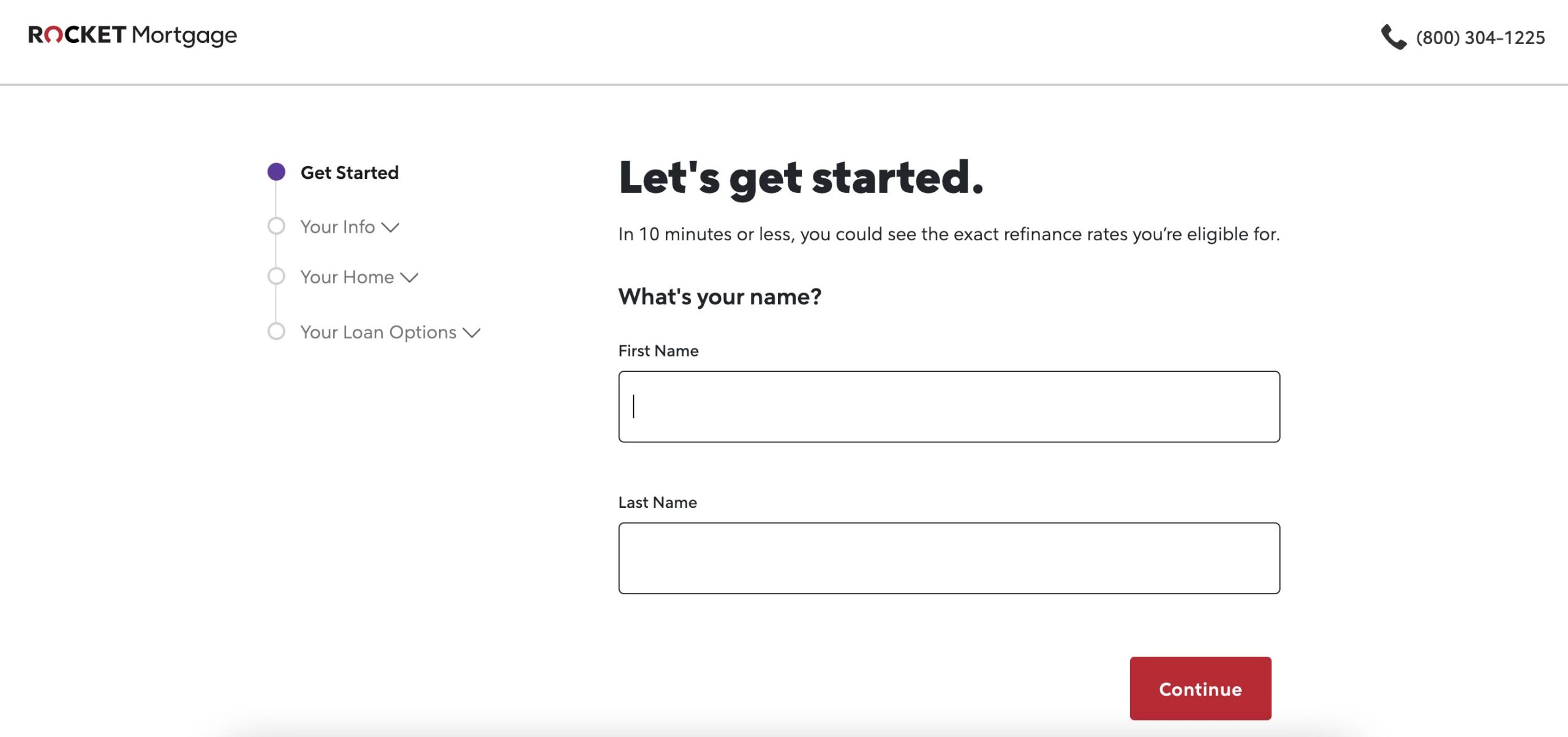

Rocket Mortgage gives borrowers three ways to apply for a home loan: online, over the phone, or through the company’s dedicated mobile app. Although this provides plenty of options during the application process, borrowers who prefer the traditional method of applying for a mortgage—sitting down with a loan officer and working out the details—may be disappointed that hands-on support will be somewhat limited. The online application process is fairly quick, as the company notes that it can often be completed in less than 10 minutes. Site visitors will need to create an online Rocket Mortgage account to complete the application process. In addition, prospective borrowers will be asked to submit to a soft credit pull so the lender can determine what rates and loan terms they might qualify for with a new purchase or refinance. However, if home buyers decide to move forward with a home loan, Rocket will need to do a hard credit pull to take a closer look at their finances and debt.

At any point during the process, borrowers have the option to pause their online application and request that a loan officer call them to walk through the remaining steps over the phone. Borrowers can also get help starting a new application by dialing the dedicated Rocket Mortgage phone number for loan assistance and speaking to a Home Loan Expert directly. Although the Rocket Mortgage customer service line isn’t open 24/7, its hours of operation are fairly long, with representatives standing by late into the evening on most days.

The final option to consider is applying for a home loan through the company’s mobile app. In addition to allowing current borrowers to manage their loans, make payments, and check their repayment schedule, Rocket’s app enables home buyers and homeowners to apply for new purchase loans and refinances from their smartphones. This approach may be appealing to digital natives and other borrowers who prefer the convenience of a mobile app. They can upload documents, sign agreements with digital signatures, and chat online with loan officers and other company representatives. Regardless of which approach a borrower chooses, they have the option to lock in their rate for up to 90 days with Rocket Mortgage’s RateShield. This can be very helpful for people who are just starting out in their house search and want to lock in their rate for an extended period of time to avoid any potential increases before their loan is approved.

Before submitting a loan application, home buyers may want to apply for preapproval. Getting a Rocket Mortgage preapproval letter can be useful when house-hunting since it shows sellers that potential buyers are likely to secure financing without much difficulty. Rocket can typically send out a loan estimate and preapproval letter within 3 business days.

Additional Services

Rocket is primarily a mortgage lender, but it does have sister companies that offer additional financing services to account holders. This may allow home buyers and homeowners to use one financial institution for all of their loan needs, which could make it easier to stay on top of their existing loans and outstanding debt. Borrowers can apply for a personal loan through Rocket Loans, using those funds to cover a variety of expenses, including making home renovations, installing solar panels, or consolidating existing debt. Eligible borrowers may be able to get prequalified for a personal loan in under a minute, and in some cases, funds may be disbursed the same day an application is submitted.

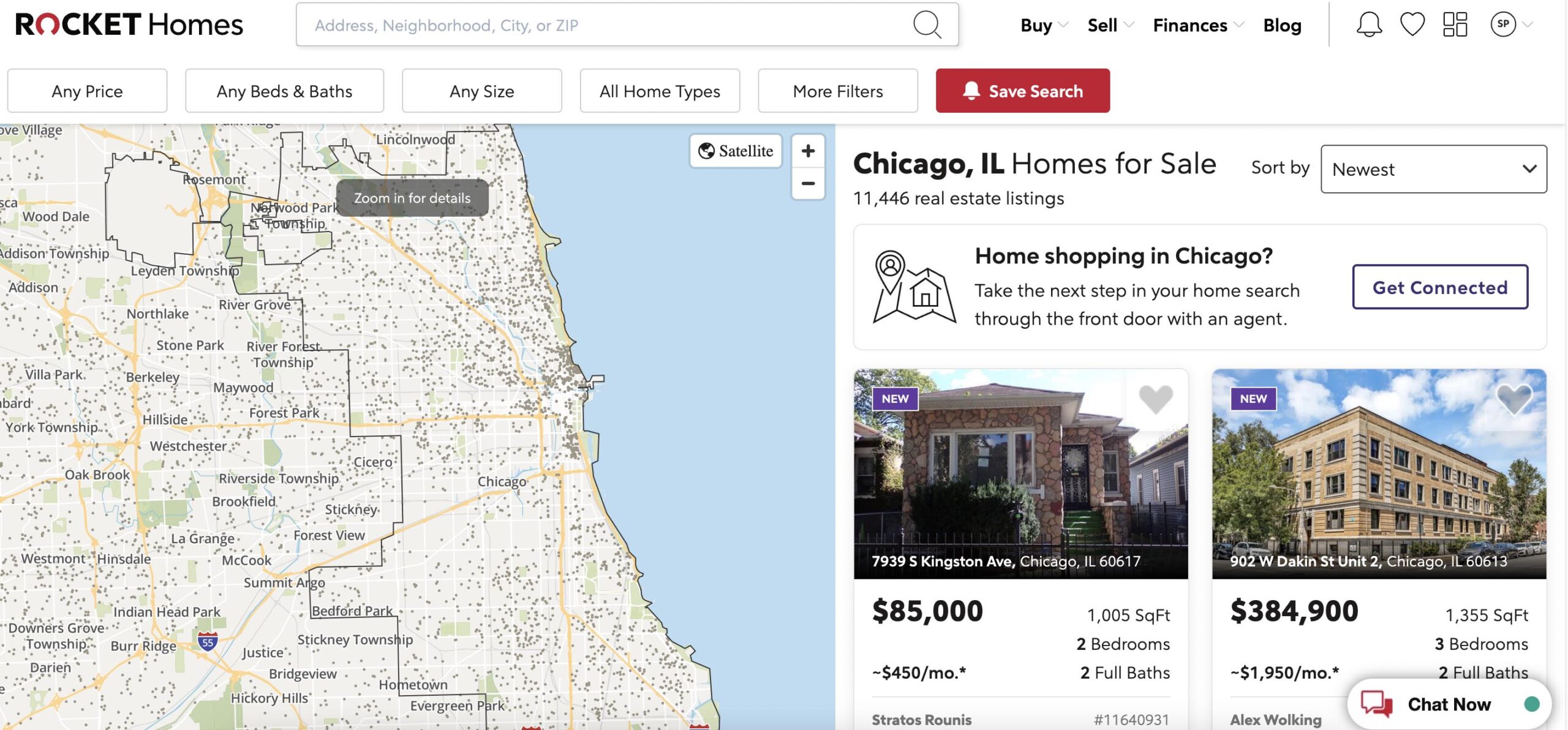

Rocket members who are in the market to buy a new car can search through Rocket Auto’s online marketplace for new and used vehicles from dealerships across the country. Although Rocket does not provide loans directly for car purchases, the company will help customers secure financing through third-party lenders. Rocket Homes, meanwhile, can assist home buyers looking for the right house to suit their needs. Members are able to search for listings in their real estate market and when they’re ready to make an offer—or if they need more assistance finding their forever home—Rocket Homes will connect them with an experienced real estate agent. As part of the broader Rocket Mortgage digital ecosystem, this platform could earn a position alongside some of the best house-hunting apps.

Customer Service

Although Rocket Mortgage is a digital-first organization, it doesn’t skimp on live customer support. There is a dedicated Rocket Mortgage phone number for both new customers and current borrowers, so anyone looking for assistance can call Rocket Mortgage and then be quickly directed to a loan officer or representative who is best equipped to address their needs. Rocket Mortgage customer service availability is solid, if not spectacular. Phone lines are not open 24/7, but representatives can offer assistance starting in the morning until very late in the day—as late as midnight, depending on the day of the week.

Site visitors also have the option to speak to a representative over virtual chat. This may be convenient for anyone who needs to ask a clarifying question or ask for assistance while in the process of submitting an online application. Online chat representatives tend to be available for longer hours compared with agents who can be reached over the phone, although they only provide support during set hours of operation.

Despite the general availability and diversity of customer service options, it’s worth noting that Rocket Mortgage does not have local branch offices for borrowers to meet with loan officers in person. Because home loans can be processed digitally from start to finish, the lack of in-person assistance may not be a concern for many home buyers. For those who prefer direct hands-on support, however, this may be a significant drawback to Rocket’s services.

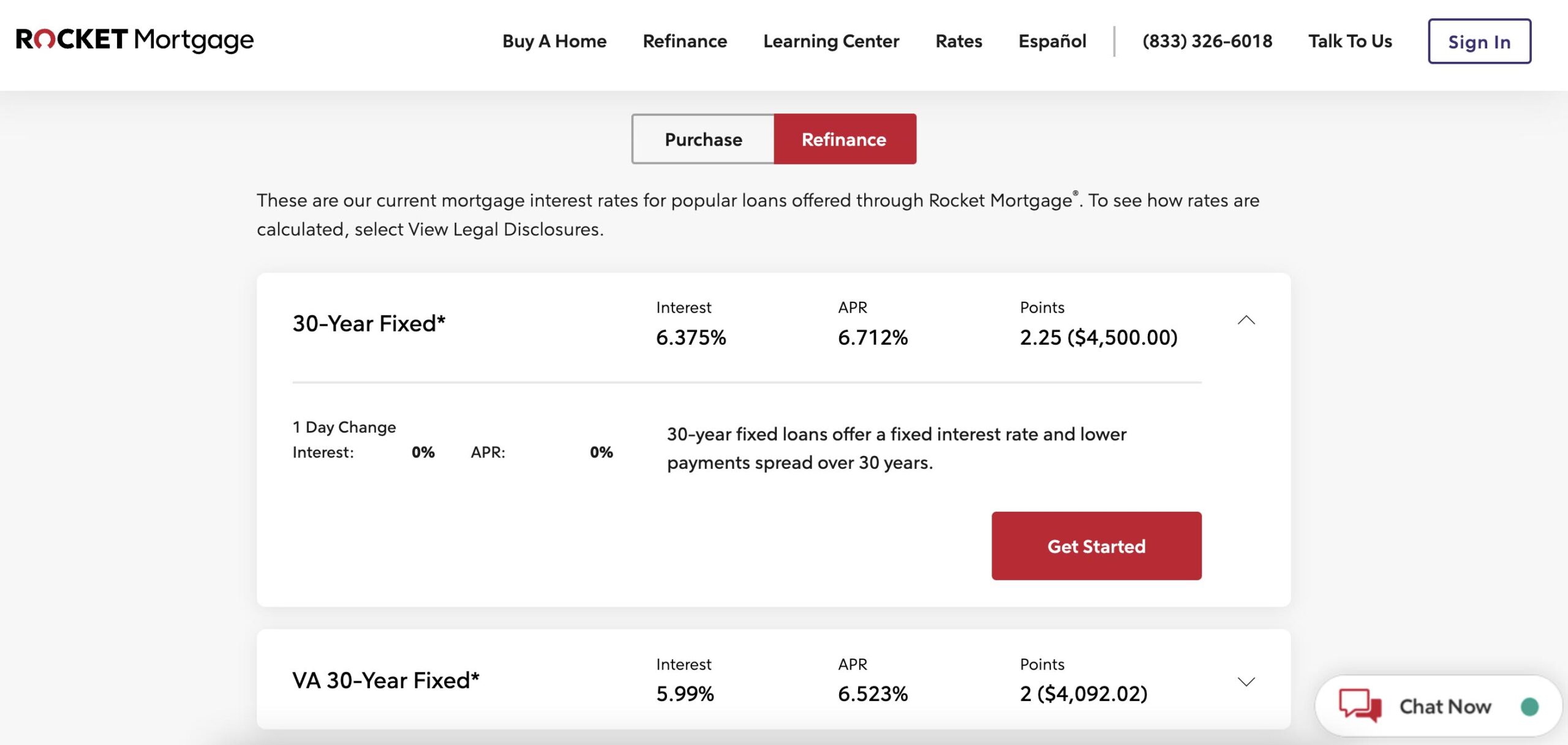

Homeowner Resources

As a digital-focused mortgage lender, Rocket Mortgage provides a number of online resources to help home buyers and homeowners throughout the loan or refinance process. Site visitors can check the latest Rocket Mortgage rates for various loan products, which are updated on a daily basis. It should be noted that published rates are based on certain assumptions regarding the borrower’s qualifications. For instance, the site’s rates assume the borrower has a 720 credit score and 30 percent DTI ratio. Published rates also reflect home loans with mortgage points, which would be an added cost that borrowers may not want to take on when getting a home loan.

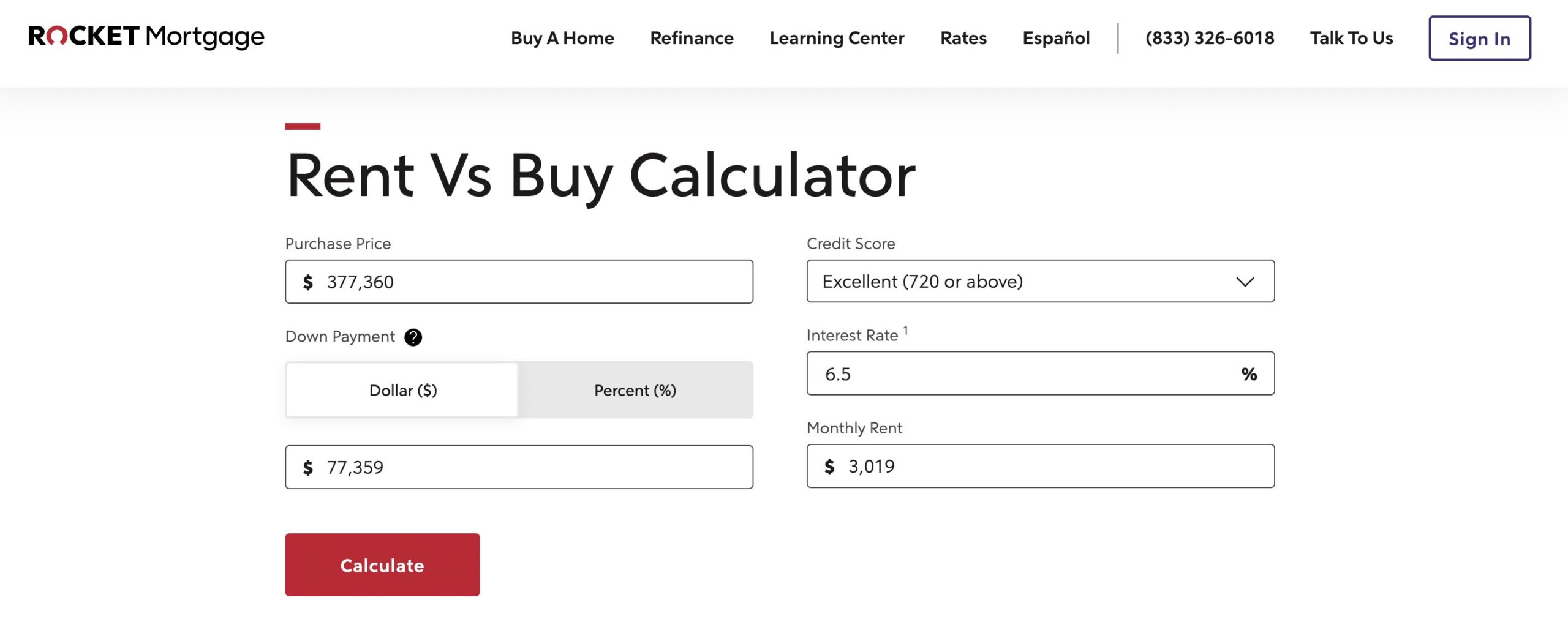

The company’s site also has mortgage calculators to help borrowers anticipate their monthly Rocket Mortgage payment, check the savings on a refinance, see how much money they could get in a cash-out refinance, and compare the costs of renting versus buying a home. These mortgage calculators are, for the most part, easy to use and understand. However, they are not easy to find on the site, and visitors may not even be aware that these tools exist.

Much of the information Rocket Mortgage provides regarding its specific loan options comes from the Learning Center section of its website. There are hundreds of guides and informational articles to help educate prospective borrowers about the mortgage process and their financing options. Visitors can quickly search for specific topics or browse resources by categories such as home buying, refinancing, and mortgage basics. The insights provided by these resources are a mix of general background information regarding mortgages and more specific details about Rocket Mortgage’s offerings.

Rocket Mortgage Reviews by Customers

Rocket Mortgage has received mostly positive feedback from borrowers across different online review sites. Credit Karma reviewers commented on the quick and hassle-free mortgage process, and some noted that the rates offered by Rocket were very competitive with other lenders. Negative feedback largely seemed to stem from individuals who were denied a home loan, which could be due to a failure to meet the lender’s eligibility requirements.

Comments submitted to Trustpilot were generally positive as well, with reviewers praising the professionalism and helpfulness of the lender’s loan officers and representatives, especially when faced with tricky financing situations. Some commenters also gave a shout-out to Rocket’s online application process—in particular, how easy it was to upload and sign documents. In some instances, however, a couple of reviewers complained that their loan applications were denied after they had received a preapproval letter.

Better Business Bureau reviews were a bit more negative overall, although the number of positive and negative reviews was fairly balanced. A common complaint revolved around the number of employees involved in the application process, which could lead to more back-and- forth. Some borrowers noted that they had multiple loan officers reach out requesting the same information and documents. It may be important to keep in mind that customer reviews are highly subjective, and one person’s experience may not be an accurate representation of the typical customer journey.

How Rocket Mortgage Stacks Up to the Competition

Compared with other lenders, Rocket Mortgage really shines with its application process. Although some home buyers may prefer to meet with a local loan officer, Rocket offers multiple ways to apply for a loan—all of which are convenient and may be a better fit for borrowers who are more comfortable with online platforms. Online applications are not, in and of themselves, unusual among lenders today, but Rocket’s platform is noteworthy for its user-friendly interface, quick workflow, and flexibility. Being able to pause and restart an application, contact a virtual representative, or even continue an in-progress application over the phone with a loan officer gives borrowers a lot of options when going through this process. In addition, the option to lock in a mortgage rate for up to 90 days is unique to Rocket, and this can help home buyers avoid rate hikes while they search for a new house.

Loan options themselves are comparable to those of many other lenders, but customers may want to take note of specific limitations presented by Rocket terms. In particular, Rocket Mortgage does not currently offer HELOCs or USDA loans, whereas lenders such as PNC, Caliber Home Loans, and Guaranteed Rate offer one or both of those financing options. Borrowers interested in ARM financing may find Rocket’s terms similarly limited, as the company offers only 7- and 10-year ARM loans. In comparison, Caliber Home Loans provides 3-, 5-, 7-, and 10-year ARMs. Despite those potential concerns, Rocket Mortgage stacks up well in other areas that are of major importance to home buyers or homeowners looking to refinance. Mortgage rates tend to sit near industry averages, and the lender’s eligibility requirements seem to be right in line with typical mortgage standards.

Should You Choose Rocket Mortgage?

Rocket Mortgage could be a good option for borrowers who would prefer to manage their home loan online as much as possible—someone looking to buy a home out of state, for instance, may benefit from Rocket’s digital-first approach and nationwide footprint. The lender offers a streamlined online application process, as well as the ability to manage a mortgage through its dedicated mobile app. Borrowers will likely need to correspond with loan officers via email, but that may be more convenient than meeting in person or talking on the phone. On the other hand, home buyers who need more direct assistance may be better served using a lender with local branch offices.

Borrowers looking for the absolute lowest interest rates may not find them with Rocket Mortgage, but the lender’s rates are competitive overall and are entirely reasonable when taking into account broader mortgage rate trends. Borrowers will also want to consider the purpose of their home loan when weighing the pros and cons of Rocket Mortgage financing. Rocket offers a number of home loans to choose from, but certain specialized financing options, such as USDA loans and HELOCs, are not available.

Despite any limitations, Rocket Mortgage provides a strong end-to-end customer experience, and borrowers may feel comfortable working with a lender that focuses exclusively on home loans. After reviewing some of the best mortgage lenders, many prospective home buyers and homeowners in the market for a refinance may find that Rocket Mortgage is the right choice for them.

We independently reviewed this service by weighing the company’s claims against first-hand experience with its professionals. However, due to factors such as franchising, human error, and more, please note that individual experiences with this company may vary.